Ethereum Price Prediction: $5,500 Target as Institutional Demand Surges

#ETH

- Technical Strength: ETH trades above key moving averages with MACD showing bullish divergence

- Institutional Demand: $10B+ inflows from ETPs and corporate treasuries creating supply shock

- Network Utility: DeFi and NFT ecosystems driving fundamental value beyond speculation

ETH Price Prediction

Ethereum Technical Analysis: Bullish Indicators Emerge Amid Consolidation

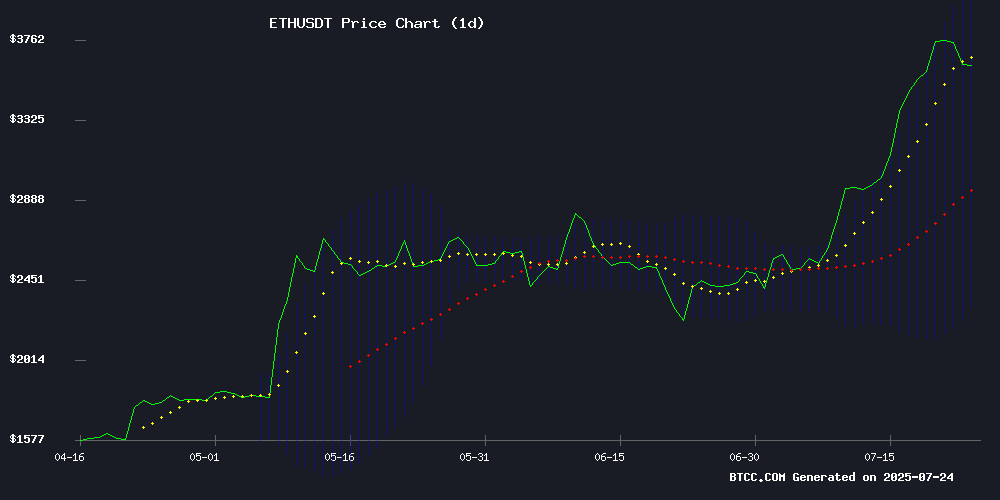

ETH is currently trading at $3,642.06, above its 20-day moving average of $3,175.61, signaling a bullish trend. The MACD remains negative but shows signs of convergence, suggesting weakening downward momentum. Bollinger Bands indicate potential volatility with the price NEAR the upper band at $4,044.22.

Market Sentiment: Institutional Demand Fuels Ethereum Optimism

Ethereum's price consolidation is accompanied by strong institutional accumulation, with ETPs and corporate treasuries snapping up $10B in ETH. Whale activity and thinning exchange supply point to bullish momentum, though short-term volatility may persist.

Factors Influencing ETH's Price

Ethereum Validator Queue Hits 18-Month High as Price Retreats From $3,800

Ethereum's validator exit queue surged to 633,000 ETH this week, the highest level since January 2024, as investors appeared to take profits following a 160% three-month rally. The network's staking mechanics now require an 11-day waiting period for withdrawals, creating measurable selling pressure.

Despite the pullback to $3,610, institutional interest persists. ethereum ETFs recorded $533 million in inflows on Tuesday, marking thirteen consecutive days of net positive flows. The simultaneous rise in both entry and exit queues suggests a reshuffling of stake rather than wholesale abandonment.

Technical indicators point to key support levels at $3,470 and $3,220 after ETH failed to sustain its breakout above $3,800. Market participants are watching whether the staking dynamics represent healthy profit-taking or signal deeper rotation out of crypto's second-largest asset.

Ozzy Osbourne’s NFT Collection Surges 400% Posthumously Before Cooling

The CryptoBatz NFT collection tied to rock legend Ozzy Osbourne saw a meteoric 400% price surge following news of his death on July 22, 2025. Data from CoinGecko reveals the Ethereum-based collectibles briefly reached 0.076 ETH before retracing 10% within 24 hours.

Launched in December 2021, the 9,666-piece collection pays homage to Osbourne's infamous 1982 bat-biting incident. "Every trait was creatively directed by Ozzy himself," states the project website, emphasizing the NFTs as permanent metaverse artifacts unlike their ill-fated real-world counterparts.

The surge mirrors patterns seen with other celebrity-linked digital assets, where scarcity combines with memorial demand. Notably, the collection had previously faced scrutiny in 2022 regarding smart contract vulnerabilities—a reminder of the speculative nature tying cultural capital to blockchain tokens.

Ethereum Whales Accumulate Heavily Amid Price Consolidation

Ethereum's price action shows $3,650 as critical support, with a breakdown potentially triggering an 8% decline. Resistance remains firm at $3,768.9, where concentrated short positions loom.

Whale activity has surged dramatically. A newly created wallet acquired 33,644 ETH ($125.73M) via FalconX, bringing its four-day accumulation to 105,977 ETH ($397M). Another entity purchased 32,640 ETH ($122.18M) OTC, amassing 43,787 ETH ($163M) in the same period.

Institutional adoption accelerates as SharpLink Gaming (NASDAQ: SBET) added 79,949 ETH last week, expanding its treasury to 360,807 ETH. The accumulation spree signals strong conviction among large holders during this consolidation phase.

Ethereum Nears $3,800 Amid Thin Exchange Supply, Bullish Indicators Emerge

Ethereum's persistent approach toward the $3,800 threshold is underscored by a critically low Exchange Supply Ratio (ESR) of 0.145, nearing this year's nadir. Thin exchange reserves historically precede upward momentum, as fewer coins sit in sell-ready positions. The current setup mirrors past rallies where suppressed ESR levels coincided with price breakouts.

Futures markets echo cautious optimism. Open interest holds at $55.9 billion with funding rates stabilizing NEAR 0.01%—elevated but not yet at the 0.02% threshold that signals excessive long leverage. This equilibrium suggests measured bullish sentiment without the froth of overextension.

Unstaking queues loom as a potential supply overhang, yet the market structure remains tilted toward accumulation. The absence of ETH flooding exchanges—a typical precursor to corrections—hints at institutional patience rather than profit-taking urgency.

DeFi Whales Withdraw $1.7 Billion in Ethereum from Aave, Justin Sun Suspected as Major Player

Decentralized finance (DeFi) whales have withdrawn a staggering $1.7 billion worth of Ethereum from Aave, the largest lending protocol on Ethereum with over $55 billion in deposits. Users typically deposit assets like Ethereum to earn interest when borrowed by others.

Marc Zeller, an Aave contributor, suggested that crypto billionaire Justin Sun is behind the majority of these withdrawals. "He’s moving billions like I go grocery shopping," Zeller remarked. Arkham Intelligence identified wallets linked to Sun, which pulled over $646 million in Ethereum from Aave in just three days. Sun-associated wallets still hold an additional $80 million on the platform.

Another $455 million in Ethereum was withdrawn by a wallet connected to HTX, where SUN serves as an advisor. London-based Abraxas Capital Management also participated in the exodus, though its exact role remains unclear.

Institutional Ethereum Accumulation Accelerates as SharpLink and BitMine Expand Strategies

SharpLink Gaming has solidified its position as the largest public holder of Ethereum, now controlling 360,807 ETH worth $1.32 billion. The Nasdaq-listed company generated 567 ETH in staking rewards, funded through operational revenue and a $96.6 million share issuance. Ethereum co-founder Joseph Lubin backs the aggressive accumulation strategy.

BitMine mirrors this institutional momentum, launching NYSE options trading to fuel its ambition of acquiring 5% of global ETH supply. The mining firm's exchange listing aims to enhance liquidity and investor access as Ethereum establishes itself as both a store of value and yield-bearing asset.

Regulatory clarity in the U.S. and growing demand for crypto treasury solutions are driving this institutional adoption wave. Both developments signal Ethereum's maturation beyond speculative asset into a Core holding for corporate balance sheets.

Crypto MEV Bot Launches Institutional-Grade Trading Software

Crypto MEV Bot (Cryptomevbot.com) has released its production-tested trading platform for both retail and institutional traders after two years of mainnet operation. The closed-source system specializes in Maximal Extractable Value (MEV) strategies, offering sub-30ms latency execution and real-time arbitrage across decentralized exchanges.

The bot's CORE capabilities include private relay bundling for 50,000 TPS throughput, smart gas fee optimization, and automated detection of profitable opportunities like large swaps and vault interactions. Deployment requires only a YAML file configuration within a Docker environment, eliminating manual coding.

MEV strategies have become increasingly crucial in crypto markets, particularly for ETH and other smart contract platforms where transaction ordering can yield significant arbitrage. The launch comes as institutional demand grows for automated trading solutions in the digital asset space.

Institutional Demand Drives Ethereum's Surge as ETPs and Corporate Treasuries Snap Up $10B in ETH

Ethereum's recent 50% monthly surge stems from a demand shock as institutional players accumulate the asset at 32 times its issuance rate. Bitwise CIO Matt Hougan identifies exchange-traded products and corporate treasuries as the driving forces behind the rally, with $5 billion flowing into spot ETH ETPs alone since mid-May.

The buying spree has removed 2.83 million ETH from circulation—equivalent to seven times the network's projected annual supply growth. Hougan anticipates this trend will intensify, forecasting $20 billion in additional institutional purchases over the next year that could create a 7:1 demand-supply imbalance at current prices.

While noting Ethereum's fundamental differences from Bitcoin, Hougan emphasizes the unprecedented scale of institutional adoption. The ETH ETP market remains in its infancy, having absorbed less than 12% of the assets that Bitcoin ETPs accumulated during their comparable growth phase.

Ethereum Price On The Verge: Institutional Demand Could Push ETH to $5,500

Crypto analyst Xanrox predicts Ethereum could surge to a record $5,500 amid growing institutional interest. Banks and state entities are reportedly accumulating ETH, with the altcoin now considered part of U.S. crypto reserves. The anticipated launch of spot Ethereum ETFs—potentially with staking features—adds further bullish momentum.

Technical analysis shows ETH trading within an ascending channel, exhibiting strong breakout potential. Despite recent six-month highs, Xanrox maintains the asset remains mid-cycle with room for appreciation. Daily flows for Ethereum products recently surpassed bitcoin ETFs for the first time, signaling shifting institutional preferences.

MoonPay Execs Linked to $250K Crypto Scam Involving Trump Associate

A federal fraud case involving cryptocurrency has drawn attention due to its connections to former President Donald Trump's inner circle and senior executives at MoonPay. The Department of Justice initially filed charges publicly on July 11, accusing a Nigerian national of impersonating Steve Witkoff—a real estate mogul and co-chair of Trump's inaugural committee—to defraud victims of $250,000 in Ethereum. The case was briefly sealed, sparking speculation about transparency and potential political sensitivities.

Legal experts noted the unusual nature of the full sealing, as DOJ typically reserves such measures for national security or covert investigations. The complaint, visible before the sealing, revealed the scammer posed as Witkoff to solicit Ethereum-based USDT transfers. MoonPay's role remains unclear, but the incident raises questions about oversight in high-profile crypto transactions.

BitMine Launches NYSE Options Trading Amid Ethereum Accumulation Strategy

BitMine Immersion Technologies has expanded its market presence with the introduction of options trading for its common stock on the New York Stock Exchange. The shares, trading under the ticker 'BMNR,' now offer investors enhanced flexibility to hedge, leverage, or speculate on the company's performance.

The MOVE aligns with BitMine's ambitious plan to acquire 5% of Ethereum's total supply—a strategy placing it among a select group of institutions aggressively accumulating ETH. Chairman Thomas Lee of Fundstrat framed the NYSE listing as a milestone, emphasizing its role in bridging traditional finance and blockchain innovation.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and institutional demand, BTCC analyst Ava projects:

| Year | Conservative | Bullish | Catalysts |

|---|---|---|---|

| 2025 | $4,200 | $5,500 | ETF approvals, EIP upgrades |

| 2030 | $12,000 | $18,000 | Mass DeFi adoption |

| 2035 | $25,000 | $40,000 | Web3 infrastructure dominance |

| 2040 | $50,000 | $75,000+ | Global settlement layer status |

Predictions assume continued network development and institutional adoption.